Oil markets had another tumultuous week, with prices now heading down. Last week, Hurricane Delta and international supply constraints lent support to prices. Those constraints have relaxed, and demand concerns have returned to the forefront. The oil price rally reversed course, handing back gains. Midweek, across-the-board draws from crude and product inventories boosted prices, but the impact did not carry through to today. Currently, WTI crude futures prices have retreated below $40.50 a barrel, and they threatened to dip below $40 a barrel in early trading today before returning to the $40.50 a barrel neighborhood. Initial unemployment claims unexpectedly surged last week. Stock markets have shown large swings. The main indices all have fallen from their highs of early September. COVID-19 cases are trending back up in the U.S., as well as in many key ally countries, shaking faith in a speedy economic recovery. The oil complex is heading for a finish in the red this week.

The unemployment situation unexpectedly worsened last week. Initial weekly unemployment claims jumped by a hefty 53,000 during the week ended October 10, coming in at 898,000. Economists had expected claims to decline to 825,000. Additionally, the prior week’s numbers were revised up by 5,000 to reach 845,000. Initial weekly claims have been below the one-million mark for seven consecutive weeks, but claims have yet to make a definitive downward movement, and they remain stuck above 800,000 each week. Prior to the pandemic, initial claims were typically 200,000-220,000 each week, and they remain over four times their pre-pandemic levels. According to data collected by the Department of Labor, during the week of March 28, initial jobless claims skyrocketed to hit a peak of 6,867,000. From that peak, initial jobless claims fell for 15 weeks. July brought a setback, and claims rose again. During the week ended August 8, claims finally fell below one million, but they were not able to sustain the downward trend. During the 30 weeks since U.S. states began to issue shelter-in-place orders, approximately 64.5 million Americans have filed initial jobless claims.

COVID-19 cases continue to rise, with data showing a setback of curve-flattening in many areas. Deaths are approaching 1.1 million worldwide. The Johns Hopkins Coronavirus Resource Center reports that global cases of COVID-19 are 38,998,580, with 1,099,469 deaths. Confirmed cases in the U.S. have risen to 7,981,009. U.S. deaths attributed to the disease have reached 217,717. There continue to be worrisome new outbreaks in the U.S., showing another increase in the latest seven-day average of new confirmed cases. Across the Atlantic, France and the U.K. are re-tightening COVID-19 restrictions. Infections are rising in other European countries including Belgium, Italy, the Netherlands, Germany, Spain, and Poland.

The unexpected jump in initial jobless claims and the stubborn increase in COVID-19 infections are raising concerns about the pace of economic recovery. While almost all parties agree on the need for another round of federal stimulus, the House favors a large relief package, while the Senate favors a trimmed-down package. The president has made inconsistent statements. Markets largely have abandoned hope that there will be a solution close at hand. The Dow Jones Industrial Average is down by approximately 343 points so far this week. The S&P 500 is down 50 points, and the NASDAQ is down 162 points. However, some earnings reports from the financial sector showed promise, and there may be some stock market recovery today.

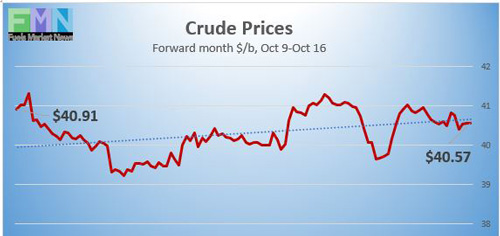

WTI crude futures prices opened at $40.88 a barrel today, down by $0.43 a barrel (1.0%) from last Friday’s open of $41.31 a barrel. Last week, prices received support from Hurricane Delta, constraints on global output, and a refined product inventory drawdown. This week, markets have headed down based on rising COVID-19 cases and the apparent extinction of hope for a federal economic stimulus bill. Initial weekly unemployment claims jumped. WTI futures prices are in the neighborhood of $40.50 a barrel currently. Prices are heading for a finish in the red. Our weekly price review covers hourly forward prices from Friday, October 9 through Friday, October 16. Three summary charts are followed by the Price Movers This Week briefing, which provides a more thorough review.

Source: Prices as reported by DTN Instant Market

Gasoline Prices

Gasoline futures prices opened at $1.1803 a gallon today on the NYMEX, compared with $1.2338 a gallon last Friday. This was a significant drop of 5.35 cents (4.3%). March brought a crippling collapse of nearly 87 cents per gallon, but prices gradually crept back up in April and May. U.S. average retail prices for gasoline declined by 0.5 cents to average $2.167/gallon during the week ended October 12. Retail prices reclaimed the territory above $2 per gallon during the first week of June. Gasoline futures are trading in the range of $1.1422/gallon to $1.1828/gallon. The week is heading for a finish in the red. The latest price is $1.1511/gallon.

Source: Prices as reported by DTN Instant Market

Diesel Prices

Diesel opened on the NYMEX today at $1.1847/gallon, down by 0.48 cents, or 0.4%, from last Friday’s open of $1.1895/gallon. U.S. average retail prices for diesel rose by 0.8 cents per gallon during the week ended October 12 to average $2.395/gallon. Diesel prices generally have weakened this year, missing some of the price recovery seen in crude and gasoline markets. The week is headed for a finish in the red. Currently, diesel is trading in the range of $1.1627-$1.190/gallon. The latest price is $1.1743/gallon.

WTI Crude Prices

Source: Prices as reported by DTN Instant Market

WTI crude forward prices opened on the NYMEX today at $40.88 a barrel, compared with $41.31 a barrel last Friday. This was a decline of $0.43 a barrel (1.0%.) Last week, the oil complex received price support from Hurricane Delta and constraints on global oil supply. The effect was temporary, and this week, larger concerns about the economy and the inability to contain the COVID-19 pandemic are back to dominate markets concerns. Prices first fell below $41 a barrel, then below $40.50 a barrel, then threatened to dip below $40 a barrel before recovering to the neighborhood of $40.50 a barrel currently. The week is headed for a finish in the red. WTI crude is trading in the $40.08–$41.05 a barrel range currently. The latest price is $40.48 a barrel.

PRICE MOVERS THIS WEEK: FULL BRIEFING

Oil markets had another tumultuous week, with prices generally trending down. Last week, Hurricane Delta and international supply constraints lent support to prices. Those constraints relaxed, and demand concerns have returned to the forefront. The oil price rally reversed course, handing back gains. Midweek, across-the-board draws from crude and product inventories boosted prices, but the impact did not carry through to today. Currently, WTI crude futures prices have retreated below $40.50 a barrel. Prices threatened to dip below $40 a barrel in early trading before returning to the $40.50 a barrel neighborhood. Initial unemployment claims unexpectedly surged last week. Stock markets have shown large swings. The main indices all have fallen from their highs of early September. COVID-19 cases are trending back up in the U.S., as well as in many key ally countries, shaking faith in a speedy economic recovery. The oil complex is heading for a finish in the red this week.

The unemployment situation unexpectedly worsened last week. Initial weekly unemployment claims jumped by a hefty 53,000 during the week ended October 10, coming in at 898,000. Economists had expected claims to decline to 825,000. Additionally, the prior week’s numbers were revised up by 5,000 to reach 845,000. Initial weekly claims have been below the one-million mark for seven consecutive weeks, but claims have yet to make a definitive downward movement, and they remain stuck above 800,000 each week. Prior to the pandemic, initial claims were typically 200,000-220,000 each week, and they remain over four times their pre-pandemic levels. According to data collected by the Department of Labor, during the week of March 28, initial jobless claims skyrocketed to hit a peak of 6,867,000. From that peak, initial jobless claims fell for 15 weeks. July brought a setback, and claims rose again. During the week ended August 8, claims finally fell below one million, but they were not able to sustain the downward trend. During the 30 weeks since U.S. states began to issue shelter-in-place orders, approximately 64.5 million Americans have filed initial jobless claims.

COVID-19 cases continue to rise, with data showing a setback of curve-flattening in many areas. Deaths are approaching 1.1 million. The Johns Hopkins Coronavirus Resource Center reports that global cases of COVID-19 are 38,998,580, with 1,099,469 deaths. Confirmed cases in the U.S. have risen to 7,981,009. U.S. deaths attributed to the disease have reached 217,717. There continue to be worrisome new outbreaks in the U.S., showing another increase in the latest seven-day average of new confirmed cases. Across the Atlantic, France and the U.K. are re-tightening COVID-19 restrictions. Infections are rising in other European countries including Belgium, Italy, the Netherlands, Germany, Spain, and Poland.

The unexpected jump in initial jobless claims and the stubborn increase in COVID-19 infections are raising concerns about the pace of economic recovery. While almost all parties agree on the need for another round of federal stimulus, the House favors a large relief package, while the Senate favors a trimmed-down package. The president has made inconsistent statements. Markets largely have abandoned hope that there will be a solution close at hand. The Dow Jones Industrial Average is down by approximately 343 points so far this week. The S&P 500 is down 50 points, and the NASDAQ is down 162 points. However, some earnings reports from the financial sector showed promise, and there may be some stock market recovery today.

The U.S. Energy Information Administration (EIA) published official inventory data for the week ended October 9. The EIA reported across-the-board inventory draws: 3.818 million barrels (mmbbls) from crude oil inventories, 1.626 mmbbls from gasoline inventories, and 7.245 mmbbls from diesel inventories. The EIA net result was a significant inventory drawdown of 12.689 mmbbls. This result exceeded the expectations of industry analysts and the American Petroleum Institute (API.) It boosted prices, but the impact faded by late Thursday.

The EIA noted that distillate fuel inventories remained high throughout the summer driving season even though two-thirds of diesel demand is used in the transport sector. Nonetheless, autumn harvest season is upon us, to be followed by winter heating season. The EIA expects that this will help drain record-high distillate inventories, though inventories are likely to remain above the five-year average (2015–19.) According to the EIA’s This Week in Petroleum report, “EIA forecasts that high inventories and lower crude oil prices will continue putting downward pressure on diesel prices through the 2020–21 winter season.”

During the worst of the oversupply, the EIA reported that crude oil in storage at Cushing rose from 35,501 barrels during the week ended January 3, 2020, to 65,446 barrels during the week ended May 1, 2020, an increase of 29,124 barrels. Cushing stocks fell to 45,582 mmbbls during the week ended June 26. However, the downward trend was reversed in July through early August, sending Cushing stocks back up to 53,289 mmbbls during the week ended August 7. Cushing stocks have trended up in September and October. The current week ended October 9 showed Cushing crude stocks at 59,442 mmbbls.

During the week ended October 2, U.S. crude production rose to 11.0 mmbpd, up by 0.3 mmbpd from the prior week, which had remained flat at 10.7 mmbpd. Approximately 0.5 mmbpd of production had been shut in to prepare for Hurricane Sally last month, but most production was quickly restored. According to the EIA, U.S. crude production averaged 13.025 mmbpd in February, the highest total ever. Production fell to 12.25 mmbpd in April, 11.52 mmbpd in May, and 10.9 mmbpd in June. Production in July rose to an average of 11.04 mmbpd. In August, however, production fell to an average of 10.475 mmbpd. Production during the first four weeks of September averaged 10.575 mmbpd. Next week’s data will show a dip because of Hurricane Delta offshore platform shut-ins.