Oil prices and stock markets continued their upward trek this week, with early and mid-week optimism now being tempered by soaring rates of COVID-19 infections. New daily cases of COVID-19 shattered records in seven of the past nine days, exceeding 100,000 new cases for the past nine days running. The surge threatens economic recovery, yet investors are showing guarded optimism for several reasons. First, the U.S. presidential election is nearing a close, with Joe Biden being declared the president-elect, although the Trump campaign continues to wage legal challenges. Second, immense progress is being made on COVID-19 vaccines. Third, Wall Street earnings reports have been upbeat today, suggesting that yesterday’s pullback may stabilize today. Fourth, initial jobless claims fell significantly last week. Fifth, gasoline and diesel inventories were cut this week, despite a crude stock build. Today, WTI crude futures prices opened at $40.94 a barrel. Crude and product prices are tapering down this morning, but so far, enough of the gains are being held so that the week appears to be heading for a finish in the black. This will build on last week’s recovery.

“This time we really mean it” seems to be the new note of urgency in entreaties from health experts trying to contain the COVID-19 pandemic. The pandemic has been at the top of the news for so long that some people complain of “pandemic fatigue” and refuse to follow measures such as mask-wearing, sanitizing and social distancing. This is particularly dangerous as the holiday season approaches. New infections in the U.S. now are rising at a hideous pace. California became the second state after Texas to record one million cases. The Johns Hopkins Coronavirus Resource Center reports that global cases of COVID-19 stand at 52,864,762, with 1,295,403 deaths. There are 10,557,451 cases in the U.S., with 242,436 deaths. According to the COVID Tracking Project, new cases in the U.S. on Thursday broke yet another record, hitting 150,526. New cases have exceeded 100,000 per day for nine consecutive days, setting new records on seven of the nine days. Hospitalizations are spiking in some areas. This may be considered the third, and worst, surge. Late-April brought a peak of 35,958 new daily cases. Mid-July brought a second peak of 76,550 new daily cases. Yesterday’s new total of 150,526 shattered old records, and it is not clear when the current surge will peak. While this week brought promising new advances in vaccine trials, it is clear that the rate of infection will have to be brought down, and that it is not safe to merely pin hopes on widespread and successful inoculations.

Source: COVID Tracking Project

Initial weekly unemployment claims fell significantly last week. According to data collected by the Department of Labor, initial claims totaled 709,000 during the week ended November 7, down by 48,000 from the prior week’s upward-revised figure of 757,000. Initial weekly claims finally subsided below the one-million mark at the end of August, but they had been stuck stubbornly above 800,000 until just the past four weeks. Prior to the pandemic, initial claims were typically 200,000–220,000 each week. During the week of March 28, initial jobless claims skyrocketed to hit a peak of 6,867,000. From that peak, initial jobless claims fell for 15 weeks. July brought a setback, and claims rose again. During the week ended August 8, claims finally fell below one million, but they were not able to sustain the downward trend. During the 34 weeks since U.S. states began to issue shelter-in-place orders, nearly 67.5 million Americans have filed initial jobless claims.

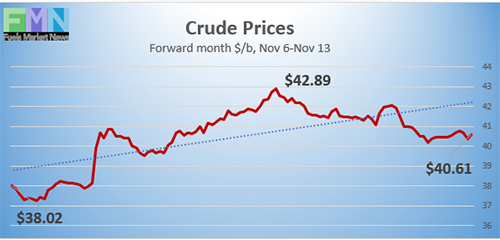

WTI crude futures prices opened at $40.94 a barrel today, an increase of $2.40 a barrel (6.2%) from last Friday’s open of $38.54 a barrel. WTI futures prices have tapered down gently today, trading mainly in the neighborhood of $40.25-$40.75 a barrel currently. Prices are heading for a finish in the black. Our weekly price review covers hourly forward prices from Friday, November 6 through Friday, November 13. Three summary charts are followed by the Price Movers This Week briefing, which provides a more thorough review.

Source: Prices as reported by DTN Instant Market

Gasoline Prices

Gasoline futures prices opened at $1.1503 a gallon today on the NYMEX, compared with $1.114 a gallon last Friday. This was a continued recovery of 3.63 cents (3.3%,) building on last week’s recovery of 8.76 cents. U.S. average retail prices for gasoline declined by 1.6 cents to average $2.096/gallon during the week ended November 9. Retail prices reclaimed the territory above $2 per gallon during the first week of June. Gasoline futures prices are falling today, trading mainly in the range of $1.12/gallon to $1.14/gallon. The week is holding on for a finish in the black. The latest price is $1.1289/gallon.

Source: Prices as reported by DTN Instant Market

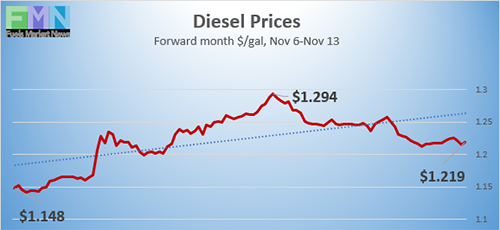

Diesel Prices

Diesel opened on the NYMEX today at $1.2269/gallon, up significantly by 5.94 cents, or 5.1%, from last Friday’s open of $1.1675/gallon. This builds on the prior week’s recovery of 8.21 cents. U.S. average retail prices for diesel rose by 1.1 cents per gallon during the week ended November 9 to average $2.383/gallon. Diesel prices generally have weakened this year, missing some of the price recovery seen in crude and gasoline markets. Currently, diesel futures prices are trending down, trading mainly in the range of $1.209-$1.227/gallon. The week appears to be holding on for a finish in the black. The latest price is $1.213/gallon.

Source: Prices as reported by DTN Instant Market

WTI Crude Prices

WTI crude futures prices opened at $40.94 a barrel today, an increase of $2.40 a barrel (6.2%) from last Friday’s open of $38.54 a barrel. Prices hit midweek highs of $42.89 a barrel before retreating. Prices today are falling in response to the worsening COVID-19 pandemic, but some weekly gains are being held. Expectations of demand recovery are falling. U.S. cases are surging faster than anywhere else in the world, with new daily cases shattering one record after another. Futures contracts are trading mainly in the range of $40.25-$40.75 a barrel currently. The week appears to be headed for a finish in the black, building on last week’s recovery. The latest price is $40.47 a barrel.

PRICE MOVERS THIS WEEK: FULL BRIEFING

Oil prices and stock markets continued their upward trek this week, with early and mid-week optimism now being tempered by soaring rates of COVID-19 infections. New daily cases of COVID-19 shattered records in seven of the past nine days, exceeding 100,000 new cases for the past nine days running. The surge threatens economic recovery, yet investors are showing guarded optimism for several reasons. First, the U.S. presidential election is nearing a close, with Joe Biden being declared the president-elect, although the Trump campaign continues to wage legal challenges. Second, immense progress is being made on COVID-19 vaccines. Third, Wall Street earnings reports have been upbeat today, suggesting that yesterday’s pullback may stabilize today. Fourth, initial jobless claims fell significantly last week. Fifth, gasoline and diesel inventories were cut this week, despite a crude stock build. Today, WTI crude futures prices opened at $40.94 a barrel. Crude and product prices are tapering down this morning, but so far, enough of the gains are being held so that the week appears to be heading for a finish in the black. This will build on last week’s recovery.

“This time we really mean it” seems to be the new note of urgency in entreaties from health experts trying to contain the COVID-19 pandemic. The pandemic has been at the top of the news for so long that some people complain of “pandemic fatigue” and refuse to follow measures such as mask-wearing, sanitizing, and social distancing. This is particularly dangerous as the holiday season approaches. New infections in the U.S. now are rising at a hideous pace. California became the second state after Texas to record one million cases. The Johns Hopkins Coronavirus Resource Center reports that global cases of COVID-19 stand at 52,864,762, with 1,295,403 deaths. There are 10,557,451 cases in the U.S., with 242,436 deaths. According to the COVID Tracking Project, new cases in the U.S. on Thursday broke yet another record, hitting 150,526. New cases have exceeded 100,000 per day for nine consecutive days, setting new records on seven of the nine days. Hospitalizations are spiking in some areas. This may be considered the third, and worst, surge. Late-April brought a peak of 35,958 new daily cases. Mid-July brought a second peak of 76,550 new daily cases. Yesterday’s new total of 150,526 shattered old records, and it is not clear when the current surge will peak. While this week brought promising new advances in vaccine trials, it is clear that the rate of infection will have to be brought down, and that it is not safe to merely pin hopes on widespread and successful inoculations.

Source: COVID Tracking Project

Initial weekly unemployment claims fell significantly last week. According to data collected by the Department of Labor, initial claims totaled 709,000 during the week ended November 7, down by 48,000 from the prior week’s upward-revised figure of 757,000. Initial weekly claims finally subsided below the one-million mark at the end of August, but they had been stuck stubbornly above 800,000 until just the past four weeks. Prior to the pandemic, initial claims were typically 200,000–220,000 each week. During the week of March 28, initial jobless claims skyrocketed to hit a peak of 6,867,000. From that peak, initial jobless claims fell for 15 weeks. July brought a setback, and claims rose again. During the week ended August 8, claims finally fell below one million, but they were not able to sustain the downward trend. During the 34 weeks since U.S. states began to issue shelter-in-place orders, nearly 67.5 million Americans have filed initial jobless claims.

The U.S. Energy Information Administration (EIA) published official inventory data for the week ended November 6. The EIA reported an unexpected addition of 4.277 million barrels (mmbbls) to crude oil inventories. This was overcome, however, by a drawdown from gasoline inventories of 2.309 mmbbls and a sizable drawdown from distillate inventories of 5.355 mmbbls. Despite the crude stock build, the EIA net result was an inventory drawdown of 3.387 mmbbls. Earlier, crude prices had received a boost from data published by the American Petroleum Institute (API,) which had reported a 5.1-mmbbl drawdown from crude oil stocks, plus gasoline and diesel inventory drawdowns that were even larger than those reported by the EIA.

During the worst of the oversupply, the EIA reported that crude oil in storage at Cushing rose from 35,501 barrels during the week ended January 3, 2020, to 65,446 barrels during the week ended May 1, 2020, an increase of 29,124 barrels. Cushing stocks fell to 45,582 mmbbls during the week ended June 26. However, the downward trend was reversed in July through early August, sending Cushing stocks back up to 53,289 mmbbls during the week ended August 7. Cushing stocks have trended up in September and October. The current week ended November 6 showed Cushing crude stocks at 60,413 mmbbls.

During the week ended November 6, U.S. crude production remained stable at 10.5 mmbpd. According to the EIA, U.S. crude production averaged 13.025 mmbpd in February, the highest total ever. Production fell to 12.25 mmbpd in April, 11.52 mmbpd in May, and 10.9 mmbpd in June. Production in July rose to an average of 11.04 mmbpd. In August, however, production fell to an average of 10.475 mmbpd before rising to 10.575 mmbpd in September. October production averaged 10.6 mmbpd.