The Convenience Technology Vision Group (CTVG) released its newest Vision Report covering two main topics: the transition to 2D barcodes and a study on AI usage in retail. The report features an executive summary of the September 13, 2024, conversation, the full meeting transcript, and additional resources for further exploration of the topic.

Top Takeaway from Sunrise 2027 and AI research presentations respectively:

- Sunrise 2027: New 2D barcodes can include personalized content creating more efficiency for retailers and better user experience for consumers.

- AI Research: Convenience Retail uses AI for mostly backend and HR matters and General Merchandise Retailers apply AI to marketing features.

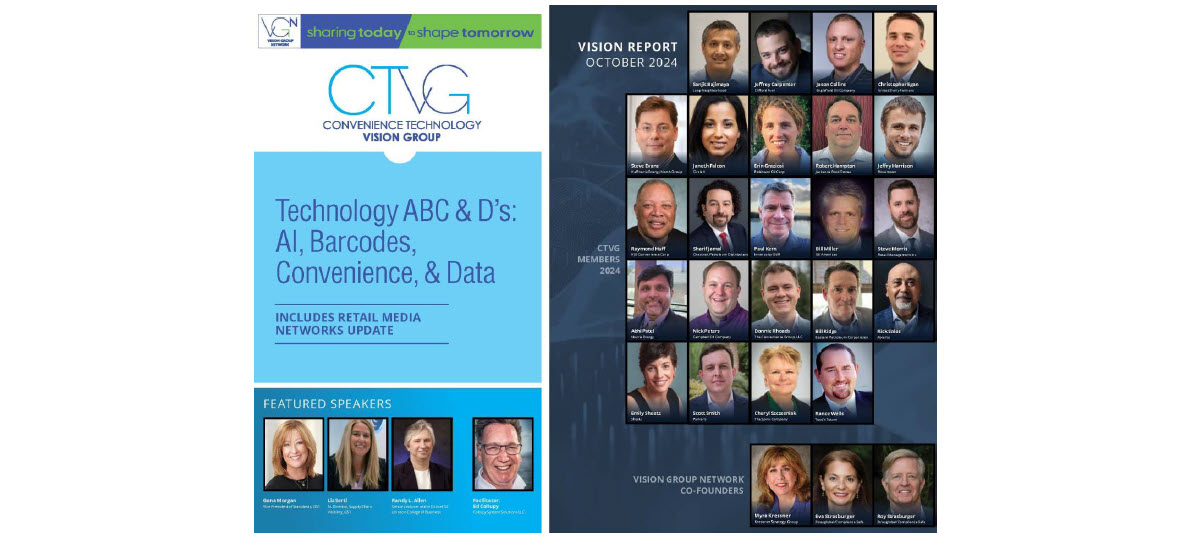

CTVG’s September 13, 2024 quarterly virtual meeting was facilitated by Ed Collupy and featured guest speakers Gena Morgan, vice president of standards and Liz Sertl, senior director of supply chain visibility, both from the non-profit global standards organization GS1, and Randy L. Allen, senior lecturer at the Cornell SC Johnson College of Business. Their presentations provided overviews of Sunrise 2027, the transition from UPC to 2D barcodes, and results from a retail executive survey on AI, respectively. CTVG members had the opportunity to share their experiences and perspectives, leading the way in bringing industry voices together on these hot topics.

The meeting was divided into two sections, each with a presentation and discussion. During the first segment, the industry-supported Sunrise 2027 transition from the 50-year-old UPC barcode to the dynamic 2D barcode was explained in technical and practical terms. By the end of December 2027, retailers and CPG products will work with 2D codes that can be encoded with more data than the historic UPC code. With information beyond product and batch number, the new codes can include consumer-friendly information like personalized content, sustainability information and potentially nutrition information.

In the second part, the group revisited the topic of AI. A study by Cornell’s SC Johnson School of Business and supported by NACS surveyed retailers in Convenience and General Merchandise sectors and found careful adoption and a familiar level of skepticism about AI implementation. Notable uses in each sector included Convenience using AI for mostly backend and HR matters, and General Merchandise retailers using AI for customer engagement activities.

Key takeaways in the report include:

UPC transition: Beyond the Beep

Participants emphasized the importance of proactive communication and careful planning for the transition, particularly in terms of implementation timelines and vendor coordination. Some wondered how the new barcodes will function in self-checkout systems, with potential issues like double scanning being highlighted. There was discussion on how the new barcodes could improve inventory control, prevent the sale of expired or recalled products, and streamline operations. Most retailers are expected to have the necessary scanning equipment by 2027 with a smooth transition expected.

Englefield Oil Company’s Director of IT, Jason Collins commented that he would look for assistance from “the point of sale and back-office price book provider and then the manufacturers of the products for the information in the 2D Barcode.”

Foodservice Applicability for 2D Barcodes

A challenge lies in how to manage packaging and labeling, especially if important details like expiration dates need to be included. The conversation then shifted toward the possibility of using 2D barcodes to replace traditional nutritional labels, sparking an interesting discussion. The broader adoption of 2D barcodes is already being tested in pilot programs by several grocery retailers in the U.S. and Europe, although no company has fully implemented the technology yet.

Presenter Gena Morgan, vice president of standards at GS1 articulated, “For 2027, all we’re really looking to do is extract the UPC and go beep. That’s the only requirement of the retailer…As you get additional data in there, it’s more than just a scanner upgrade in order to ingest the lot batch code and do something with that.”

AI’s Challenges for Smaller Retailers and Partnering With Vendors

The Cornell study found differing views on AI between executives and operational teams, particularly in smaller retailers. Larger organizations may have dedicated teams for business innovation, while smaller retailers, often constrained by limited resources, rely heavily on third-party vendors for AI solutions. Many smaller IT teams are primarily focused on day-to-day operational issues, making large-scale AI implementations difficult without external help. The cost of AI research and development was highlighted as a significant barrier for smaller companies. A common theme was the reliance on vendor partnerships to develop practical and affordable AI tools, as smaller retailers wait for vendors to lead the way in implementing AI solutions.

AI Use Cases and Practical Applications

Practical AI use cases such as training, marketing, and store operations were offered by CTVG members. AI tools in digital marketing were noted for their potential to help retailers respond to customer reviews, while others emphasized AI’s role in improving employee efficiency and customer service. AI can streamline mundane tasks, allowing employees to focus on higher-margin activities. Some shared specific applications, like using AI to create tailored reports for different roles or exploring computer vision AI for operational tasks, though cost and development issues remain challenges. AI has also been used to enhance online presence and manage social media. However, some cautioned that many retailers still struggle with basic marketing, suggesting AI could eventually open new creative opportunities for convenience stores to enhance their brand storytelling.

The meeting concluded with an announcement of the new Conexxus Vision Group (CxVG) launching in November 2024 which has been created to expand Connexus’ retailer and supplier executive level engagement and to amplify Conexxus’ goals and mission.

Lightning Round Review

During a fast-paced review, members and guests revisited the topic of retail media networks (RMNs) from the previous June 2024 CTVG meeting. Participants shared updates from their organizations and insights from industry events including the challenges of scaling RMNs, the potential of AI-driven advertising, and the importance of leveraging first-party data. The conversation highlighted varying perspectives on the viability of RMNs, with some seeing promise through collective efforts and personalized advertising, while others questioned the return on investment.

To download this and other Vision Group Network Vision Reports, please CLICK HERE.

About Convenience Technology Vision Group

The Convenience Technology Vision Group (CTVG) brings together invited leaders for quarterly virtual meetings to discuss technology issues impacting the convenience channel. The group addresses trends, challenges and solutions in AI, computer vision, alternative payments, robotics, IoT, blockchain, cybersecurity, data analysis, EVs, food tech, frictionless checkout, digital experiences, workforce management and more. The group is committed to sharing its views and perspectives in order to advance the convenience retailing and mobility industry. CTVG operates under the Vision Group Network, which gathers the collective knowledge and ideas of its members to create a legacy of sharing within the retail community. For more information about CTVG, visit vgnsharing/ctvg or contact us.

About Vision Group Network

The Vision Group Network (VGN) brings together, in virtual groups and face-to-face meetings, great minds and leaders from all parts of the retail and foodservice industries around the globe to create a knowledge base consisting of experience and innovative ideas. The mixture of perspectives, real world experiences and collaboration during VGN’s Convenience Leaders Vision Group (CLVG), Convenience Technology Vision Group (CTVG) and The Vision Group (TVG) meetings provide valuable insights and actionable programs that allow its members to maximize their business opportunities. Electric Vehicles Vision Group (evVG) and Conexxus Vision Group (CxVG) are launching in November 2024. Global Convenience Vision Group (GCVN) and Convenience Foodservice Vision Group (CFVG) are launching in January 2025.

To learn more about the Vision Group Network and to join the mailing list for all Vision Reports visit vgnsharing.com.