Analysis by Dr. Nancy Yamaguchi

The U.S. Energy Information Administration (EIA) released its weekly data on diesel and gasoline retail prices for the week ended December 24, 2018. Data release was delayed for the Christmas holiday. Retail prices for both fuels continued to fall. On a national average basis, gasoline prices dropped by 4.8 cents/gallon, while diesel prices fell by 4.4 cents/gallon. Gasoline prices have fallen drastically since October, reaching a point where the national average price is below where it was one year ago.

Crude oil, gasoline and diesel prices continued to fall in futures markets. During the week ended December 21, West Texas Intermediate (WTI) crude futures prices dropped sharply by $5.66/b. Gasoline futures prices plummeted by 11.79 cents/gallon. Diesel futures prices fell dramatically by 11.25 cents/gallon. As of the time of this writing, WTI futures crude prices are recovering from a collapse that brought prices to their lowest levels since February 2016. Because retail prices tend to follow crude price movements; if the current crude price trend persists, next week’s retail prices should continue to decline.

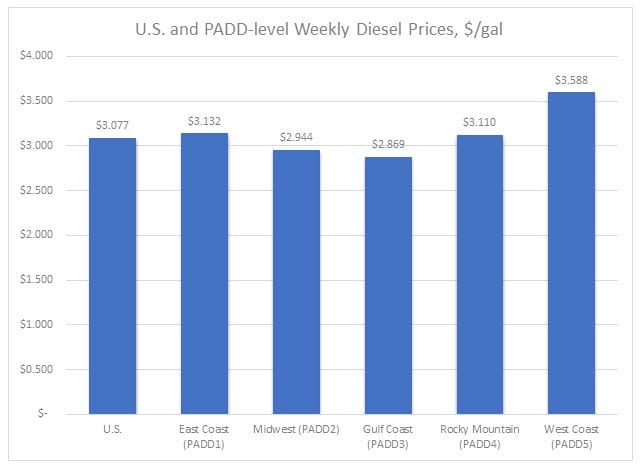

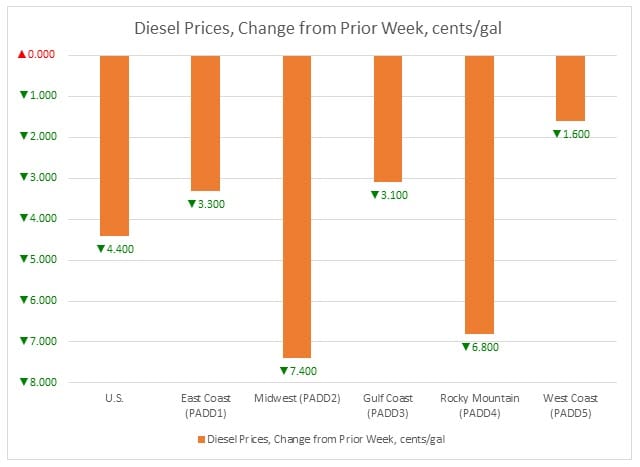

For the current week ended December 24, diesel prices dropped by 4.4 cents to an average price of $3.077/gallon. This was the tenth consecutive week that retail diesel prices have fallen. During these ten weeks, the price decline has amounted to 31.7 cents/gallon. Prices fell in all PADDs. The national average price was 17.4 cents per gallon higher than it was one year ago.

In the East Coast PADD 1, diesel prices fell by 3.3 cents to arrive at an average price of $3.132/gallon. Within PADD 1, New England prices declined by 3.9 cents to average $3.237/gallon. Central Atlantic diesel prices fell by 3.2 cents to average $3.310/gallon. Lower Atlantic prices fell by 3.4 cents to arrive at an average price of $2.987/gallon. PADD 1 prices were 22.8 cents/gallon above their prices for the same week last year.

In the Midwest PADD 2 market, retail diesel prices dropped by 7.4 cents to average $2.944/gallon. This was the largest price decrease among the five PADDs. PADD 2 now joins PADD 3 in having diesel prices below $3/gallon. Prices were 9.0 cents/gallon above their level for the same week last year.

In the Gulf Coast PADD 3, retail diesel prices declined by 3.1 cents to average $2.869/gallon. Four weeks ago, PADD 3 became the first PADD where retail diesel prices fell below the $3/gallon mark. Prices were 16.1 cents higher than for the same week in the previous year.

In the Rocky Mountains PADD 4 market, retail diesel prices dropped by 6.8 cents to average $3.110/gallon. PADD 4 prices were 16.2 cents higher than in the prior year.

In the West Coast PADD 5 market, retail diesel prices declined by 1.6 cents to average $3.588/gallon. This price was 27.6 cents above its level from last year. Prices excluding California fell by 3.2 cents to reach an average of $3.281/gallon. This price was 25.5 cents above the retail price for the same week last year. California diesel prices edged down by 0.3 cents to arrive at an average price of $3.832/gallon. California diesel prices were 29.3 cents above last year’s price.

U.S. retail gasoline prices fell by 4.8 cents to average $2.321/gallon during the week ended December 24th. Prices fell in all PADDs. The national average price was 15.1 cents per gallon lower than it was one year ago. Prices in PADDs 1, 2 and 3 are below their levels of one year ago. Retail prices for gasoline have fallen for the past eleven weeks, slashing 58.2 cents/gallon off the average retail price.

For the current week ended December 24, East Coast PADD 1 retail prices for gasoline dropped by 5.5 cents to average $2.297/gallon. The average price was 12.9 cents below last year’s price. Within PADD 1, New England prices fell by 5.3 cents to average $2.461/gallon. Central Atlantic market prices declined by 5.2 cents to average $2.460/gallon. Prices in the Lower Atlantic market dropped by 5.6 cents to average $2.149/gallon.

In the Midwest PADD 2 market, retail gasoline prices dropped by 5.4 cents to reach an average price of $2.081/gallon. Six weeks ago, PADD 2 became the first and only PADD where gasoline pump prices were lower than they were one year ago. PADD 1 and 3 joined PADD 2 in this distinction four weeks ago. PADD 2 prices for the current week were an astonishing 32.8 cents/gallon lower than they were for the same week last year.

In the Gulf Coast PADD 3 market, gasoline prices fell by 5.0 cents to average $1.981/gallon. PADD 3 continues to have the lowest average prices among the PADDs. Two years ago, in December 2016, PADD 3 gasoline prices were below the $2/gallon level. Now, PADD 3 prices have once again fallen below this threshold. Prices for the week were 18.9 cents lower than for the same week in 2017.

In the Rocky Mountains PADD 4 market, gasoline pump prices dropped sharply by 9.0 cents to arrive at an average of $2.485/gallon. This was the largest price drop among the PADDs. Prices were 3.5 cents higher than at the same time in 2017.

In the West Coast PADD 5 market, retail gasoline prices fell by 3.0 cents to arrive at an average of $3.084/gallon. PADD 5 prices were 11.8 cents higher than at the same time a year ago. PADD 5 continues to have the highest gasoline prices among the five PADDs, and it is the only PADD where average retail gasoline prices remain in excess of $3/gallon. Excluding California, West Coast prices declined by 4.3 cents to average $2.877/gallon. This was 20.0 cents higher than at the same time in 2017. In California, pump prices decreased by 1.8 cents to average $3.253/gallon. California prices were 12.0 cents per gallon above their levels from last year.