Fuels Market Watch 24

Exclusive daily fuels market analysis by Dr. Nancy Yamaguchi.

FUEL MARKETS TODAY – Market Overview

Crude oil and refined product prices fell over the past 24 hours. WTI (West Texas Intermediate) crude prices in today’s trading session opened at $67.88/b, down by $0.76 from yesterday’s opening. Gasoline and diesel futures prices opened significantly lower in today’s session. The price gains achieved last week largely have been eroded, and the oil complex appears to be heading for a finish in the red this week.

The Energy Information Administration (EIA) released weekly supply data for the week ended August 31st. The data showed a significant drawdown of 4.302 mmbbls from crude oil inventories. However, this was more than counterbalanced by inventory additions of 1.845 mmbbls of gasoline and 3.119 mmbbls of diesel, for a net gain of 0.662 mmbbls of oil in storage. Earlier, the American Petroleum Institute (API) had estimated that crude oil inventories were drawn down by 1.2 mmbbls, gasoline inventories rose by 1.0 mmbbls, and diesel inventories rose by 1.8 mmbbls, resulting in a net inflow of 1.6 mmbbls to storage. Although the EIA numbers were less bearish, the oil complex slid on news of the large additions to refined product inventories. These can be viewed as indicative of weak demand despite the Labor Day weekend, though the numbers may have been skewed by stormy weather.

According to EIA data, weekly U.S. crude production stayed flat at 11.0 million barrels per day (mmbpd.) Over the course of the year to date, production has risen by 1.5 mmbpd. The EIA projects that production will average 10.68 mmbpd in 2018, and that it will reach 11.7 mmbpd in 2019.

The U.S. Bureau of Labor Statistics (BLS) just released the Jobs Report for August. The unemployment rate remained unchanged at an extraordinarily low 3.9%. Recall that in 2009, at the height of the Great Recession, the unemployment rate had gone as high as 10%. It declined gradually each year since as the economy healed. The unemployment rate dropped to 5% in 2015, and it is averaging only 4% during the first eight months of 2018. The U.S. economy has been in a prolonged period of expansion, and many market watchers are concerned that trade wars will dampen economic activity.

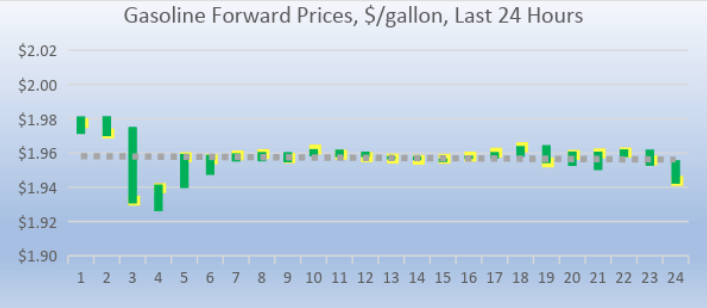

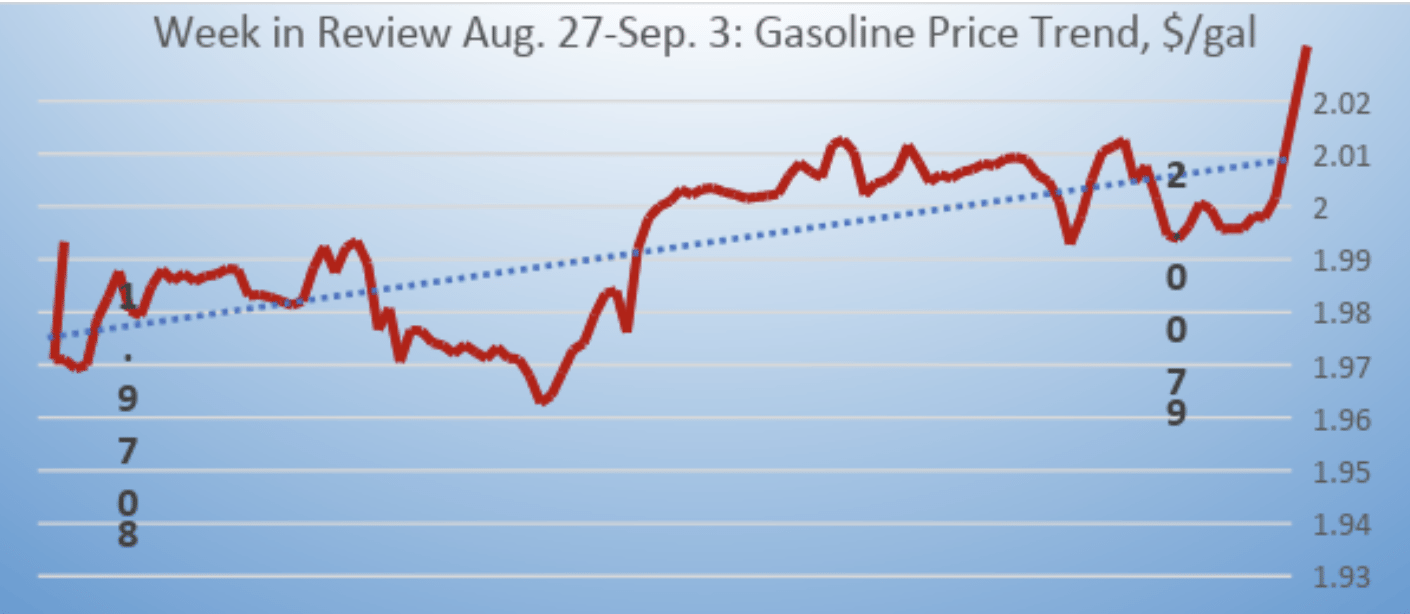

GASOLINE

Gasoline opened on the NYMEX at $1.9555 today, down by 0.71 cents from yesterday’s opening. Over the last 24-hour period from 9AM EST to 9AM EST, gasoline prices dropped by 2.28 cents/gallon (1.15%.) Currently, gasoline prices are continuing to weaken. The latest price is $1.9429/gallon.

DIESEL

Diesel opened on the NYMEX at $2.2091/gallon today, down significantly by 2.31 cents from yesterday’s opening. Over the last 24-hour period from 9AM EST to 9AM EST, diesel prices fell significantly by 3.31 cents/gallon (1.48%.) This morning, diesel prices dropped again, and they now are hovering in the range of are stable in the range of $2.19-$2.22/gallon. The latest price is $2.1964/gallon.

WEST TEXAS INTERMEDIATE

WTI (West Texas Intermediate) crude prices opened on the NYMEX at $67.88/b today, down by $0.76 from yesterday’s opening price. Over the last 24-hour period from 9AM EST to 9AM EST, crude prices fell by $1.18/b (1.71%.) Currently, crude prices are continuing to fall. The latest price is $67.12/b.