Fuels Market Watch 24

Exclusive daily fuels market analysis by Dr. Nancy Yamaguchi.

FUEL MARKETS TODAY – Market Overview

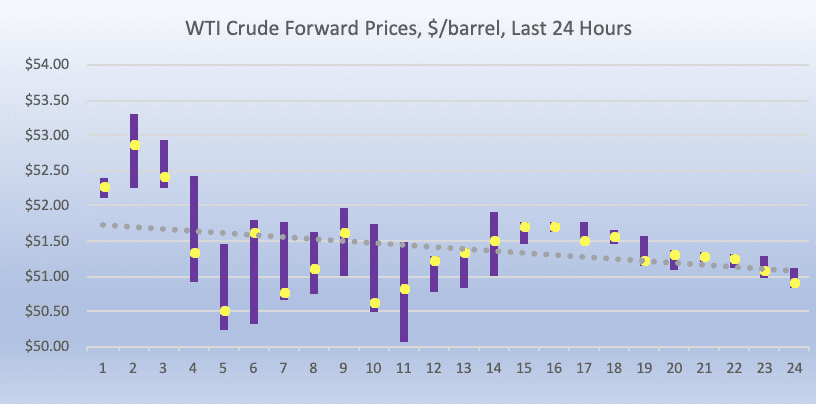

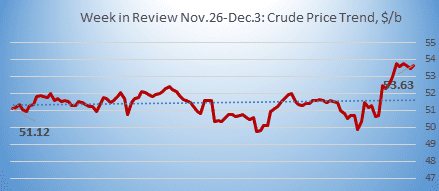

Oil prices have just taken a leap upward. The price surge is based on fresh news of a strong U.S. Jobs Report and an agreement among OPEC and NOPEC countries to curb output by 1.2 million barrels per day. WTI (West Texas Intermediate) crude forward prices opened at $51.76/b today, a drop of $1.17 (2.21%) from yesterday’s opening price of $52.93/b. Diesel futures prices also were down at market opening this morning, while gasoline prices had declined only slightly. Refined fuel prices appeared ready to end the week in the black, whereas crude oil prices looked to be heading for a finish in the red. This morning, however, the Jobs Report and the OPEC-NOPEC deal have boosted market optimism, and the oil complex now is heading for a week in the black. (Note that our price charts show only the 24-hour period ending at 6AM PST, and the jump in prices came that hour, so the upward movement in prices is not fully reflected.)

The U.S. Bureau of Labor Statistics (BLS) has just released the Jobs Report for November. The unemployment rate remained unchanged at 3.7%. The BLS reported that the U.S. added 155,000 jobs in November. Economists had expected a higher number, approximately 198,000. Nonetheless, this is positive news for the U.S. economy, finally, and oil prices jumped in response.

The Energy Information Administration (EIA) released official statistics on weekly U.S. supply and demand yesterday. The data were delayed for the National Day of Mourning for former President George H.W. Bush. The results should have been unusually bullish for the market, showing that crude oil inventories were drawn down by 7.323 mmbbls during the week ended November 11th. Gasoline stockpiles grew by 1.699 mmbbls, and diesel inventories grew by 3.811 mmbbls. The net drawdown was 1.813 mmbbls. The drawdown of crude stocks was the first in ten weeks.

The official statistics contrasted sharply with the inventory numbers released on Tuesday by the American Petroleum Institute (API.) The API reported major additions to all three commodities: 5.36 mmbbls of crude oil, 3.61 mmbbls of gasoline, and 4.32 mmbbls of diesel, amounting to a massive net addition of 13.29 mmbbls to inventories.

The EIA data news should have motivated bullish traders, but the reaction was muted by collapsing equities markets and the inability to reach agreement on an OPEC-NOPEC cut in crude production. Now that there is success on the OPEC-NOPEC front today, prices have risen sharply. The agreement specifies a production cut of 1.2 million barrels per day. OPEC countries will cut output by 800,000 bpd, and the Russian-led coalition of non-OPEC countries will cut 400,000 bpd.

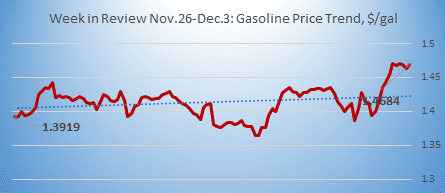

GASOLINE

Gasoline opened on the NYMEX at $1.441/gallon today, down fractionally by 0.16 cents (0.11%) from yesterday’s opening price of $1.4426 cents/gallon. Over the last 24-hour trading period from 9AM EST to 9AM EST, gasoline prices jumped by 10.19 cents/gallon (7.28%.) Currently, gasoline prices have regained the range of $1.48-$1.50/gallon. The latest price is $1.4938/gallon.

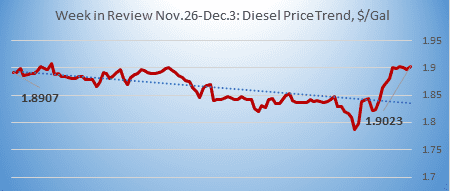

DIESEL

Diesel opened on the NYMEX at $1.8667/gallon today, a decline of 2.19 cents (1.15%) from yesterday’s opening price of $1.8886/gallon. Over the last 24-hour period from 9AM EST to 9AM EST, diesel prices jumped by 8.69 cents/gallon (4.7%.) Currently, diesel prices have risen to the range of $1.92-$1.94/gallon. The latest price is $1.9296/gallon.

WEST TEXAS INTERMEDIATE

WTI (West Texas Intermediate) crude prices opened at $52.93/b today, up slightly by $0.34 (0.65%) from yesterday’s opening price of $52.59/b. Over the last 24-hour period from 9AM EST to 9AM EST, crude futures dropped again by $1.28/b (2.44%.) As noted above, however, the Jobs Report and the news of an OPEC-NOPEC production cut agreement has just caused a price surge. Oil prices have hit peak highs of $54/b, and they currently are in the range of $53.50/b-$54.00/b. The latest price is $53.63/b.