Fuels Market Watch 24

Exclusive daily fuels market analysis by Dr. Nancy Yamaguchi.

FUEL MARKETS TODAY – Market Overview

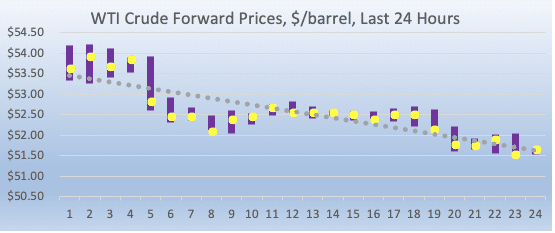

Oil futures prices are falling this morning. Last Friday brought a small rebound, based upon a strong U.S. Jobs Report and the announcement that key OPEC and NOPEC countries had agreed to curb crude oil output. There are doubts about the effectiveness and speed of the production cuts. More importantly, global equities continue to fall today, as investors price in the impacts of weaker economic growth. The oil complex managed to finish in the black last week, but prices have been falling since then. WTI (West Texas Intermediate) crude forward prices opened at $52.03/b today, up by $0.27 (0.52%) from Friday’s opening price of $51.76/b. Gasoline and diesel also opened with modest gains this morning. All are trending down currently.

WTI futures prices opened last week on Monday at $52.45/b, which was $1.18/b above the prior Friday’s opening price. Crude prices were volatile during the week, rising upon market opening on Monday and Tuesday, falling on Wednesday, rising on Thursday, and falling on Friday. Friday’s prices rose during the day, and they managed to squeak into a finish in the black at $52.61/b at market close on Friday, a small weekly gain of $0.16 (0.3%.)

Product prices finished last week more securely in the black. Gasoline prices opened last week at $1.4126/gallon on Monday, and prices rose by 7.32 cents (5.2%) during the week to finish at $1.4858/gallon on Friday. Diesel prices opened on Monday at $1.8425/gallon, and prices rose by $4.37 cents (2.4%) cents to finish at $1.8862/gallon on Friday.

After last week’s finish, prices have been sliding. The global equities selloff is continuing. The outlook for economic growth is cooling, and rising tensions between the U.S. and China threaten their ability to reach an agreement on the trade war. The Dow Jones Industrial Average has slipped into the red for the year, a huge blow to investors.

The announcement of the OPEC-NOPEC production cut agreement bolstered prices on Friday. But after a spate of buying, a sober outlook set in, acknowledging that the production cuts would take months to achieve—just as they did before. Iran, Libya and Venezuela were granted exemptions from the OPEC side of the cuts. Iran and Libya remain under sanctions from the U.S., while Libyan output is often constrained by outages. Libya declared force majeure on exports from El Sharara oilfield after militants seized the facility.

GASOLINE

Gasoline opened on the NYMEX at $1.464/gallon today, up by 2.3 cents (1.52%) from Friday’s opening price of $1.4426 cents/gallon. Over the last 24-hour trading period from 9AM EST to 9AM EST, gasoline prices fell by 4.22 cents/gallon (2.81%.) Currently, gasoline prices have subsided to the range of $1.44-$1.46/gallon. The latest price is $1.4528/gallon.

DIESEL

Diesel opened on the NYMEX at $1.8786/gallon today, an increase of 1.19 cents (0.6%) from Friday’s opening price of $1.8667/gallon. Over the last 24-hour period from 9AM EST to 9AM EST, diesel prices dropped by 6.76 cents/gallon (3.49%.) Currently, diesel prices have fallen to the range of $1.85-$1.87/gallon. The latest price is $1.8633/gallon.

WEST TEXAS INTERMEDIATE

WTI (West Texas Intermediate) crude forward prices opened at $52.03/b today, up by $0.27 (0.52%) from Friday’s opening price of $51.76/b. Over the last 24-hour period from 9AM EST to 9AM EST, crude futures dropped again by $2.35/b (4.36%.) After hitting peak highs of over $54/b on Friday, WTI crude oil prices have subsided back below $52/b, and prices are declining. The latest price is $51.43/b.